The Elliott Wave Theory, developed by Ralph Nelson Elliott, is a popular technical analysis tool used to predict market trends by identifying recurring wave patterns. One of the most common corrective wave patterns within this framework is the Zig-Zag pattern. This article explains the Zig-Zag pattern, its structure, rules, and guidelines for effective application in trading.

What is a Zig-Zag Pattern?

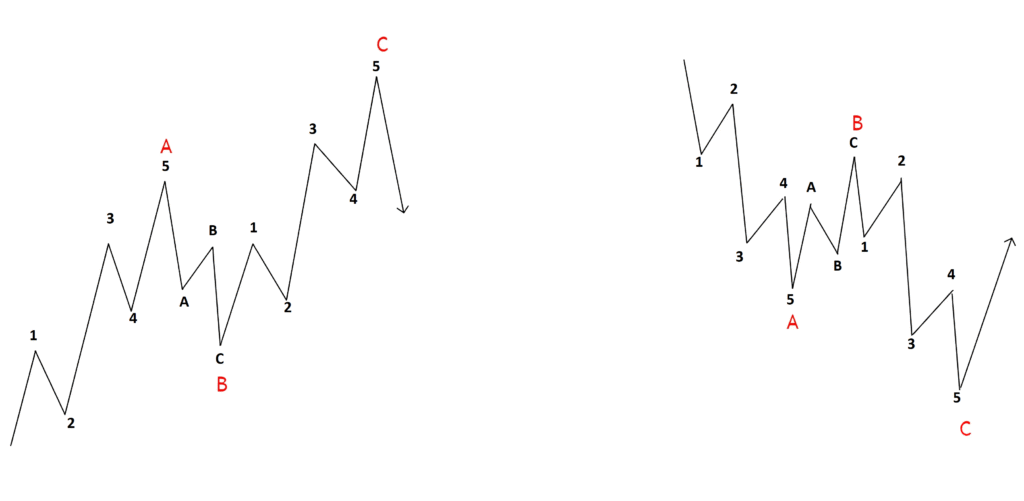

A Zig-Zag is a corrective wave pattern that moves against the larger trend, typically consisting of three waves labeled A, B, and C. It is a sharp, counter-trend movement that often appears in the corrective phases of a larger Elliott Wave cycle (e.g., wave 2 or wave 4). The Zig-Zag pattern is characterized by its distinct structure, making it recognizable in charts across various markets, including stocks, forex, commodities and cryptocurrencies.

Structure of a Zig-Zag

The Zig-Zag pattern comprises three waves:

- Wave A: A five-wave move in the direction of the correction (against the larger trend).

- Wave B: A three-wave corrective move that retraces a portion of Wave A, typically moving in the direction of the larger trend.

- Wave C: Another five-wave move in the same direction as Wave A, often extending to a similar length as Wave A or beyond.

The structure is denoted as 5-3-5, referring to the wave counts of A, B, and C, respectively.

Rules of the Zig-Zag Pattern

To correctly identify a Zig-Zag pattern, the following rules must be adhered to:

- Wave A must be an impulse wave or a leading diagonal: Wave A consists of five sub-waves, confirming its motive nature.

- Wave B must be a corrective wave: Wave B consists of three sub-waves and should not retrace more than 80% of Wave A.

- Wave C must be an impulse wave or an ending diagonal: Wave C is also a five-wave structure and typically equals or exceeds the length of Wave A.

- Wave B retracement: Wave B must retrace less than 80% of Wave A to maintain the corrective nature of the zig zag pattern.

Guidelines for Analyzing Zig-Zags

While the rules are strict, guidelines provide flexibility and context for practical application:

- Wave B Retracement Levels: Wave B often retraces 38.2%, 50%, or 61.8% of Wave A, aligning with Fibonacci retracement levels.

- Wave C Length: Wave C is commonly equal to Wave A (1:1 ratio) or extends to 1.618 times the length of Wave A, following Fibonacci extension levels.

- Time Factor: Wave C typically takes a similar amount of time to form as Wave A, though this is not mandatory.

- Alternation: If Wave B is a shallow retracement (e.g., less than 50%), Wave C is likely to be longer. Conversely, a deep Wave B retracement often leads to a shorter Wave C. If Wave A is an impulse wave, Wave C can unfold as a diagonal and vice versa.

Common Pitfalls

- Mislabeling Waves: Ensure Wave A and Wave C are five-wave structures, not three-wave corrections.

- Ignoring the Larger Trend: Always analyze Zig-Zags within the context of the broader Elliott Wave count to avoid misinterpretation.

- Overcomplicating Patterns: Stick to the 5-3-5 structure and avoid forcing complex patterns into a Zig-Zag framework.

Conclusion

The Zig-Zag pattern is a powerful tool for traders employing Elliott Wave analysis. By understanding its 5-3-5 structure, adhering to its rules, and applying Fibonacci-based guidelines, traders can better anticipate market corrections and reversals. However, like all technical analysis tools, Zig-Zags should be used alongside other indicators and risk management strategies to enhance accuracy and decision-making.

Happy Trading!