The Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a popular technical analysis tool used to forecast market trends by identifying recurring price patterns. At its core, the theory posits that markets move in repetitive cycles driven by investor psychology, forming waves. One of the key components of this theory is the impulse wave, a directional price movement that aligns with the broader market trend. This article explains the impulse wave, its structure, and the rules and guidelines governing it.

What is an Impulse Wave?

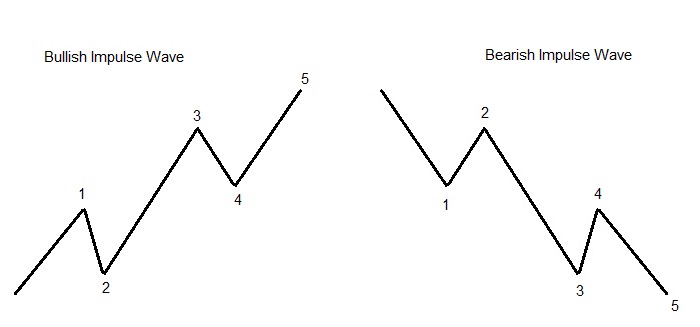

An impulse wave is a strong, directional price movement that reflects the dominant trend in a market, either bullish (upward) or bearish (downward). It consists of five distinct sub-waves, labeled 1, 2, 3, 4, and 5, which together form a complete cycle. Impulse waves are critical because they indicate the direction of the larger trend and are followed by corrective waves (typically three waves, labeled A-B-C) that move against the trend.

Structure of an Impulse Wave

- Wave 1: The initial move in the direction of the trend, often driven by early adopters or new market sentiment.

- Wave 2: A corrective wave that retraces part of Wave 1 but does not exceed its starting point.

- Wave 3: The strongest and longest wave, reflecting powerful momentum in the trend’s direction.

- Wave 4: A corrective wave that retraces part of Wave 3, typically less severe than Wave 2.

- Wave 5: The final wave, completing the impulse as momentum wanes, often accompanied by divergence in technical indicators.

Rules Governing Impulse Waves

Impulse waves must adhere to strict rules to be valid within the Elliott Wave framework. These rules are non-negotiable and help distinguish impulse waves from other patterns:

- Wave 1 must be an impulse or a leading diagonal (a wedge-like pattern with overlapping waves).

- Wave 2 cannot retrace more than 100% of Wave 1. In other words, it cannot fall below the starting point of Wave 1 in a bullish trend (or rise above it in a bearish trend).

- Wave 3 cannot be the shortest among Waves 1, 3, and 5 in terms of price movement. It is typically the longest and most dynamic wave.

- Wave 4 cannot overlap with the price territory of Wave 1. This means Wave 4 (in a bullish trend) cannot end below the high of Wave 1, except in rare cases involving diagonal patterns.

- Wave 5 must be an impulse or an ending diagonal and must complete the sequence without violating the trend’s direction.

Guidelines for Impulse Waves

In addition to the strict rules, there are guidelines that describe common characteristics of impulse waves. These are not mandatory but help analysts identify and interpret waves more effectively:

- Wave 2 often retraces 50% to 61.8% of Wave 1, following Fibonacci ratios, and is typically sharp and quick.

- Wave 3 is usually the longest and never the shortest, often extending 161.8% or more of Wave 1’s length.

- Wave 4 tends to be shallower, retracing 38.2% to 50% of Wave 3, and often forms complex patterns like triangles or flats.

- Wave 5 may equal the length of Wave 1 or extend to 161.8% of the distance from the start of Wave 1 to the end of Wave 3.

- Alternation: Waves 2 and 4 often differ in complexity or structure. If Wave 2 is simple (e.g., a zigzag), Wave 4 is likely to be complex (e.g., a triangle), and vice versa.

- Channeling: Impulse waves often fit within parallel trend channels, with Wave 4 typically bouncing off the lower channel line in an uptrend (or upper line in a downtrend).

Conclusion

The impulse wave is a cornerstone of Elliott Wave Theory, providing a structured way to analyze market trends. By adhering to its strict rules—such as the non-overlap of Wave 4 and the length of Wave 3—and using guidelines like Fibonacci retracements and alternation, traders can better anticipate price movements. While powerful, the theory demands careful study and experience to master, making it a valuable tool for those willing to invest the time.

Happy Trading!