The Elliott Wave Flat is a corrective pattern in Elliott Wave Theory, a technical analysis framework used to predict market trends. It typically occurs within a larger trend, serving as a countertrend movement that temporarily interrupts the primary direction. Flats are three-wave patterns labeled A-B-C, and they reflect periods of consolidation or indecision in the market.

Structure of a Flat

A Flat consists of three waves:

- Wave A: Moves against the prevailing trend (e.g., downward in an uptrend).

- Wave B: Retraces a significant portion of Wave A, moving in the direction of the main trend.

- Wave C: Moves in the same direction as Wave A, often extending to or slightly beyond the end of Wave A.

The internal structure of a Flat follows a 3-3-5 wave count:

- Wave A: A three-wave corrective pattern.

- Wave B: A three-wave corrective pattern.

- Wave C: A five-wave pattern (impulsive wave or ending diagonal).

Types of Flats

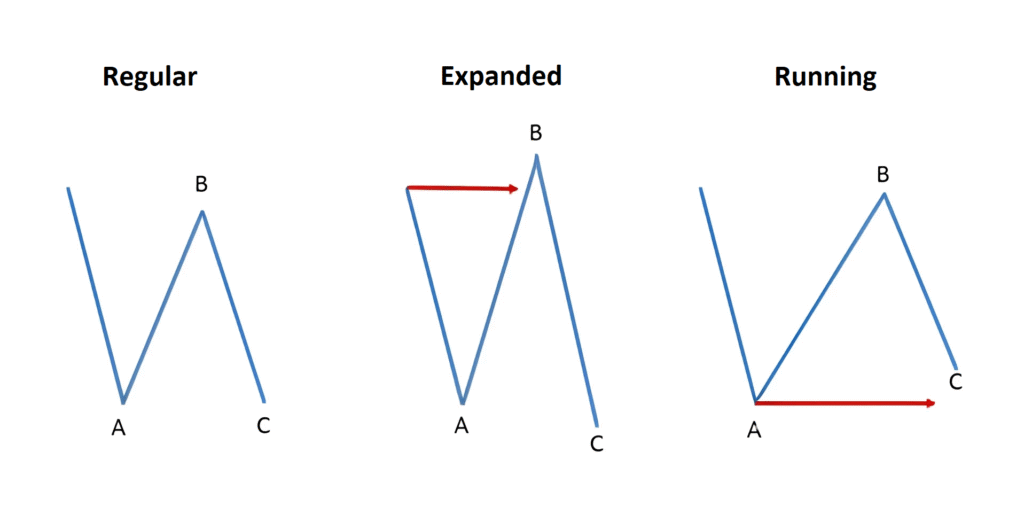

There are three main types of Flat patterns, distinguished by the relative lengths of Waves A, B, and C:

- Regular Flat: Wave B retraces 80-100% of Wave A, and Wave C is roughly equal in length to Wave A.

- Expanded Flat: Wave B retraces more than 100% of Wave A (often 123.6-161.8%), and Wave C extends beyond the end of Wave A.

- Running Flat: Wave B retraces significantly (often close to or beyond Wave A’s start), but Wave C fails to reach the end of Wave A, resulting in a shorter corrective move.

Rules for Identifying a Flat

To confirm a Flat pattern, the following strict rules must be met:

- Wave A must be a corrective three-wave structure (not impulsive).

- Wave B must retrace at least 80% of Wave A but cannot exceed 161.8% in most cases.

- Wave C must be a five-wave structure and should at least reach the endpoint of Wave A (except in Running Flats).

- The overall A-B-C pattern must correct the prior trend, not advance it.

Guidelines for Flats

While rules are rigid, guidelines provide flexibility and context:

- Wave B Retracement: Typically retraces 80-138% of Wave A. In Expanded Flats, retracements can exceed 138%.

- Wave C Length: Often equals Wave A or extends to 161.8% of Wave A in Expanded Flats.

- Time Symmetry: Waves A and B often take similar amounts of time to complete, while Wave C is faster and sharper.

- Fibonacci Relationships: Wave C commonly ends at key Fibonacci levels relative to Wave A (e.g., 100% or 161.8% of Wave A’s length).

- Market Context: Flats often appear in wave 2, wave 4, or as part of complex corrections like Double or Triple Three Combinations.

Conclusion

The Elliott Wave Flat is a versatile corrective pattern that helps traders navigate market consolidations. By understanding its rules (3-3-5 structure, retracement levels) and guidelines (Fibonacci relationships, time symmetry), traders can better anticipate price movements and make informed decisions. Whether regular, expanded, or running, Flats are a key tool in the Elliott Wave framework for decoding market behavior.

Happy Trading!