An Elliott Wave Diagonal is a specific pattern within Elliott Wave Theory, a technical analysis framework used to forecast market trends by identifying recurring price patterns. Diagonals are motive waves, meaning they move in the direction of the larger trend, but they differ from standard impulse waves due to their unique structure and characteristics. They typically appear in two forms: Leading Diagonals and Ending Diagonals. This article explains what an Elliott Wave Diagonal is, along with its rules and guidelines.

What is an Elliott Wave Diagonal?

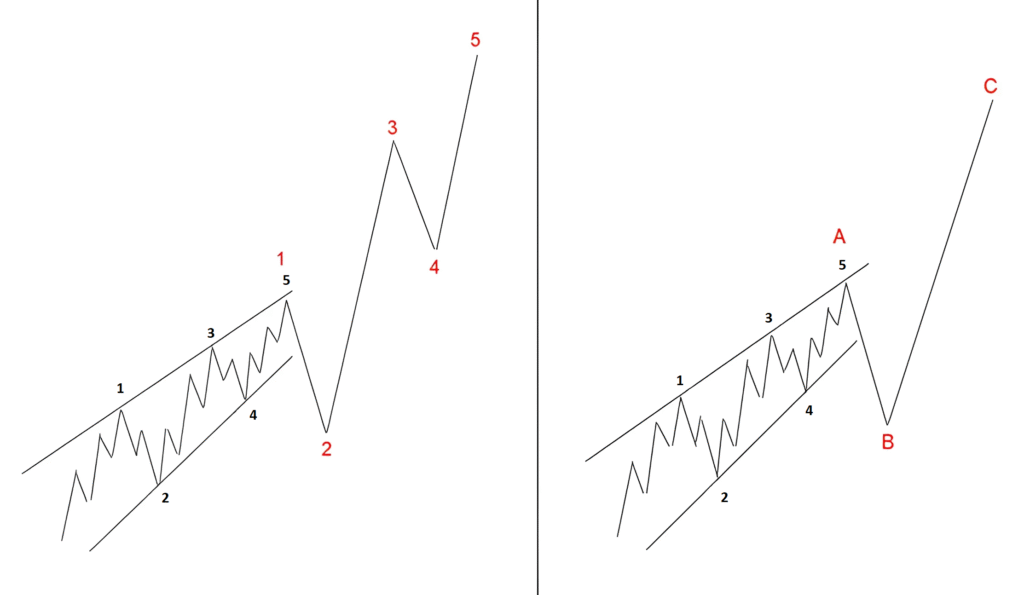

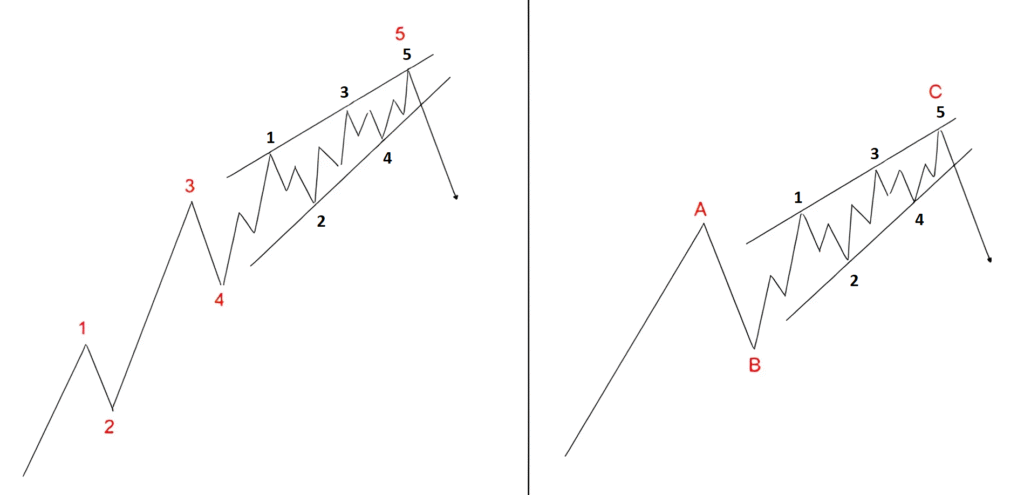

A diagonal is a five-wave pattern labeled 1-2-3-4-5, where each wave subdivides into three smaller waves (a zigzag or corrective structure) or five and three smaller waves (5-3-5-3-5). Unlike impulse waves, which have a clean, directional thrust, diagonals form a wedge-like shape, with converging trendlines. They reflect a weakening trend, often signaling the start (Leading Diagonal) or end (Ending Diagonal) of a larger move.

- Leading Diagonal: Appears in the first wave of an impulse or the A wave of a correction. It suggests the trend is beginning but lacks strong momentum.

- Ending Diagonal: Occurs in the fifth wave of an impulse or the C wave of a correction. It indicates the trend is exhausting, often preceding a sharp reversal.

Rules for Elliott Wave Diagonals

Diagonals must adhere to strict rules to be valid:

- Five-Wave Structure: The pattern consists of five waves (1-2-3-4-5), each subdividing into three sub-waves (a-b-c) in the case of a 3-3-3-3-3 structure.

- Wedge Shape: The upper and lower trendlines of the pattern converge, forming a wedge. This distinguishes diagonals from impulses. Less commonly, an expanding diagonal may unfold.

- Wave 2 Retracement: Wave 2 cannot retrace more than 100% of Wave 1.

- Wave 3 Length: Wave 3 always passes beyond the termination point of Wave 1.

- Position: Leading Diagonals appear in Wave 1 or Wave A positions, while Ending Diagonals appear in Wave 5 or Wave C positions.

Guidelines for Elliott Wave Diagonals

While rules are mandatory, guidelines provide additional context but are not always strictly followed:

- Wave Lengths: In a contracting diagonal, each wave is shorter than the one before it (wave 5 < wave 3 < wave 1). In an expanding diagonal, each wave is longer than the one before it (wave 5 > wave 3 > wave 1).

- Sub-Wave Structure: Each wave (1, 2, 3, 4, 5) usually subdivides into a zigzag (5-3-5 structure) in the case of a 3-3-3-3-3 structure.

- Symmetry: The converging trendlines should form a clear wedge, with Wave 5 often approaching or touching the upper trendline (in an uptrend) or lower trendline (in a downtrend).

- Volume and Momentum: Diagonals often show declining volume and momentum, especially in Ending Diagonals, reflecting trend exhaustion.

- Post-Pattern Behavior: After an Ending Diagonal, expect a sharp reversal or correction. After a Leading Diagonal, the market often continues in the direction of the trend after a brief retracement.

Conclusion

Elliott Wave Diagonals are powerful patterns for understanding market dynamics. Their wedge shape, overlapping waves, and specific positioning make them distinct from other wave patterns. By following the strict rules and considering the guidelines, traders can better navigate market trends and reversals, improving their decision-making in technical analysis.

Happy Trading!