Elliott Wave Theory, developed by Ralph Nelson Elliott, is a popular technical analysis tool used to predict market trends by identifying repeating price patterns. Among its advanced concepts is the Elliott Wave Combination, a corrective pattern that occurs when the market consolidates in a complex, sideways movement. This article explains the structure, rules, and guidelines of Elliott Wave Combinations.

What is an Elliott Wave Combination?

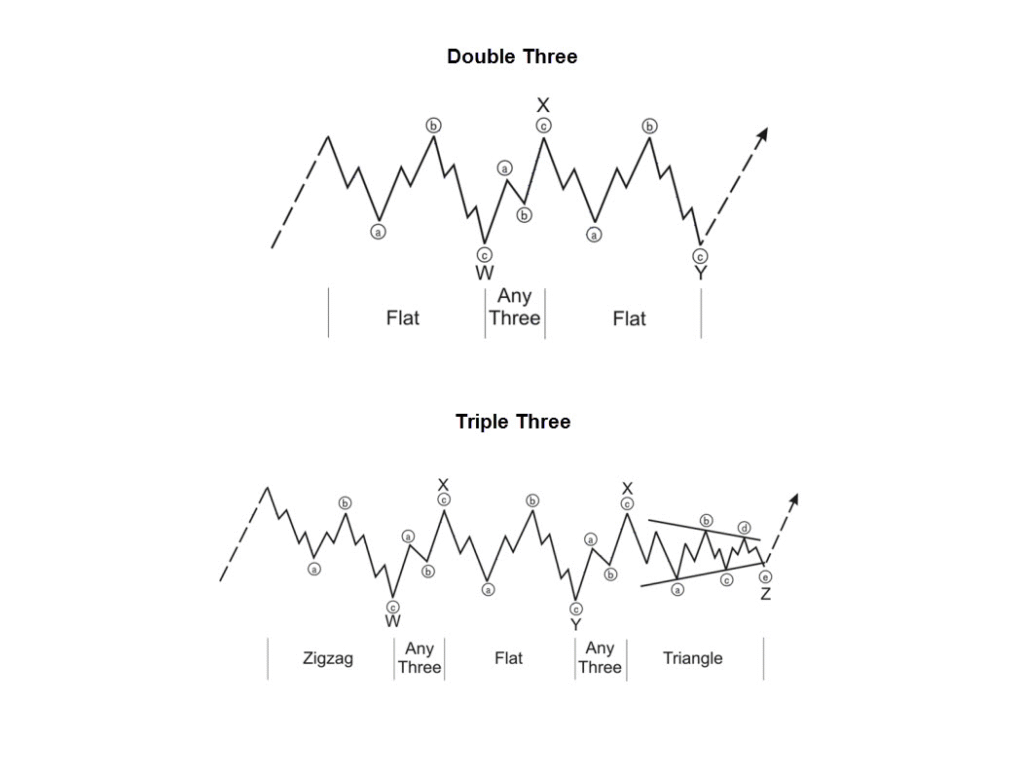

A Combination is a corrective pattern in Elliott Wave Theory that combines two or three simpler corrective patterns, typically connected by an intervening wave labeled “X.” Combinations usually appear in complex market corrections, extending the duration of a sideways or range-bound price movement. They are often seen in wave 2, wave 4, or wave B of an Elliott Wave sequence.

Combinations typically involve a sequence of corrective patterns, such as:

- Flat + Zigzag

- Flat + Triangle

- Zigzag + Flat

- Zigzag + Triangle

Each corrective pattern within the combination is separated by an X-wave, which is itself a corrective structure.

Structure of a Combination

A Combination is labeled as W-X-Y (for double three combination) or W-X-Y-X-Z (for triple three combination). Here’s the breakdown:

- W: The first corrective pattern (usually a zigzag or a flat).

- X: An intervening corrective wave that connects the first and second patterns (any corrective pattern or a fake impulse*).

- Y: The second corrective pattern (any corrective pattern).

- X (second): In triple combinations, another intervening wave connecting to a third pattern.

- Z: The third corrective pattern in a triple combination (any corrective pattern).

The combination resolves when the final corrective pattern (Y or Z) completes, leading to the resumption of the larger trend.

* A fake impulse travels a great distance like an impulse wave but does not have five waves.

Rules of Elliott Wave Combinations

To correctly identify and label a Combination, strict rules must be followed:

- Corrective Patterns Only: The W, Y, and Z waves must be corrective patterns (zigzag, flat, or triangle). They cannot be impulsive (five-wave) structures. Wave W can never be a triangle.

- X-Wave is Corrective: The X-wave(s) must also be a corrective structure, typically a zigzag, but it can occasionally take the shape of any corrective pattern or a fake impulse.

- Subdivision Consistency: Each corrective pattern (W, Y, Z) must adhere to the rules of its respective structure. For example, a zigzag must have a 5-3-5 internal structure, and a flat must have a 3-3-5 structure.

- No Overlap in Triangles: If a triangle is part of the combination (usually in the Y or Z position), its sub-waves must not overlap in price.

- Time and Complexity: Combinations must take more time than a single corrective pattern and appear more complex in structure.

Guidelines for Elliott Wave Combinations

While rules are mandatory, guidelines provide additional context for identifying Combinations:

- Alternation: The W and Y (or Z) patterns often alternate in type. For example, if W is a zigzag, Y is likely to be a flat or triangle.

- X-Wave Size: The X-wave is typically smaller and faster than the W or Y waves but can retrace a significant portion (often 50%–61.8%) of the W wave.

- Channeling: Combinations often form within parallel channels or a range-bound price zone, reflecting the sideways nature of the correction.

- Fibonacci Relationships: The Y-wave often equals the W-wave in length or relates to it by Fibonacci ratios (e.g., 61.8%, 100%, or 161.8%). The X-wave may retrace 38.2%–61.8% of the W-wave.

- Time Extension: Combinations take longer to complete than simple corrections, often spanning several bars or candles on a chart.

- Triangle as Final Pattern: In many cases, the final pattern (Y or Z) is a triangle, signaling the end of the correction and the resumption of the larger trend.

Conclusion

Elliott Wave Combinations are powerful tools for understanding complex market corrections. By following their strict rules and guidelines, traders and analysts can better anticipate the end of a corrective phase and the resumption of the primary trend. Mastering Combinations requires practice, but their predictive power makes them a valuable addition to any technical analyst’s toolkit.

Happy Trading!